THE QUANTITIES OF ZEOLITE REMAIN UNEXPLOITED

The huge amounts of zeolite that exist in the Evros region in northeastern Greece remain [...]

Jun

MINING EUROPE IS A GOOD FIT FOR GREECE

During the last years Europe has increased productivity in the exploitation of mineral wealth and [...]

Jun

MUSEUM OF MINING AND METALLURGY OF LAVRIO

The establishment of the Museum of Mining and Metallurgy of Lavrio and the restoration of [...]

Jun

GREEK MINING COMPANIES: THE PROS AND CONS IN 2015

The year 2015 is expected to bring similar results with the previous fiscal year in [...]

Jun

MICHALIS THEODORAKOPOULOS: “IN GREECE, ENTREPRENEURSHIP HAS BEEN DEMONIZED”

The CEO of Hellas Gold – subsidiary of EL Dorado Gold-, operating at the mines [...]

Jun

THE LOSSES OF ELDORADO GOLD & THE CONSEQUENCES ON THE GREEK MARKET

The involvement of the company Hellas Gold – subsidiary of EL Dorado Gold – in [...]

Jun

GREECE-RUSSIA SIGN MEMORANDUM OF COOPERATION FOR NATURAL GAS PIPELINE PROJECT

Greek and Russian authorities on Friday signed a memorandum of cooperation for the construction of [...]

Jun

GIVING BACK

In 2011, the Indonesian government was given the task of transforming 443ha of revegetated land [...]

Jun

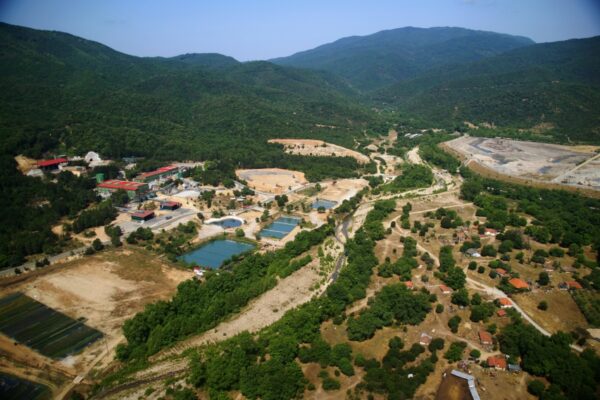

ELDORADO GOLD ANNOUNCES OLYMPIAS DEVELOPMENT UPDATE

(all figures in US dollars unless otherwise noted) VANCOUVER, June 11, 2015 /CNW/ – Eldorado Gold [...]

Jun

FOCUSING ON SAFE PRODUCTION OF GOLD

The modern gold mining industry in Europe has nothing to do with the past practice. [...]

Jun