Tag Archives: gold

US lab mines gold from discarded SIM cards

Researchers at the Sandia National Laboratories in Albuquerque are using ultrasonic waves to strip gold [...]

Apr

Keith Neumeyer: The numbers sound crazy, but I predict $8,000 gold & $130 silver

Keith says the reason the resource markets are lagging is due to institutions not entering [...]

Nov

This new method for getting gold from e-waste may be just what miners need

A small Canadian company’s new way of extracting gold and other precious metals is showing [...]

Oct

Scientists use gold to improve microlaser technology

By attaching gold nanoparticles to the surface of a microlaser, scientists at the University of [...]

Oct

Where are the country’s gold reserves stored?

Where are the country’s gold reserves stored? This question is answered by the “Kathimerini” newspaper [...]

Mar

As markets rally, should you still hold gold?

Trump’s election victory has tempered demand for the yellow metal A desire to hold “real [...]

Nov

2016 already best year ever for world’s largest gold ETF

Once the largest fund of its kind in the world, top physical gold-backed exchange traded [...]

Jul

Gold and the environment

Gold nanoparticles could be the solution to a number of pressing environmental concerns. Catalytic converters [...]

May

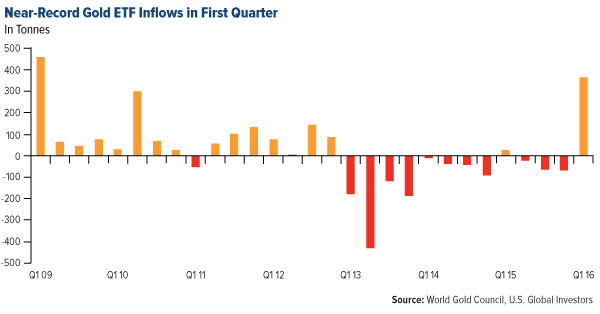

Gold demand just had its strongest-ever first quarter

This year’s first quarter is one for the history books. Not only did gold appreciate [...]

May

The global experiment with negative interest rates is fantastic news for gold

The longer the world’s central banks continue to experiment with negative interest rates, the better [...]

Mar

- 1

- 2