Category Archives: News

Mining stocks in broad sell-off as copper, gold prices pull back

Mining stocks retreated across the board on Thursday after the gold price fell sharply and [...]

Jun

Scientists find new way to power electric cars using cobalt

Researchers at the University of Massachusetts Lowell developed a technique that uses only water, carbon [...]

Mar

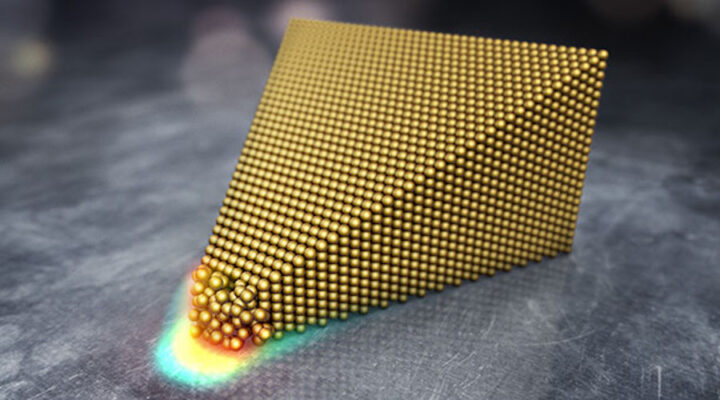

Melting gold at room temperature is a thing now

Researchers from Chalmers University of Technology, the University of Gothenburg, the University of Jyväskylä, and [...]

Dec

Scotland closer to having its first commercial gold mine

Scotland is one step closer to having its first commercial gold and silver mine as [...]

Oct

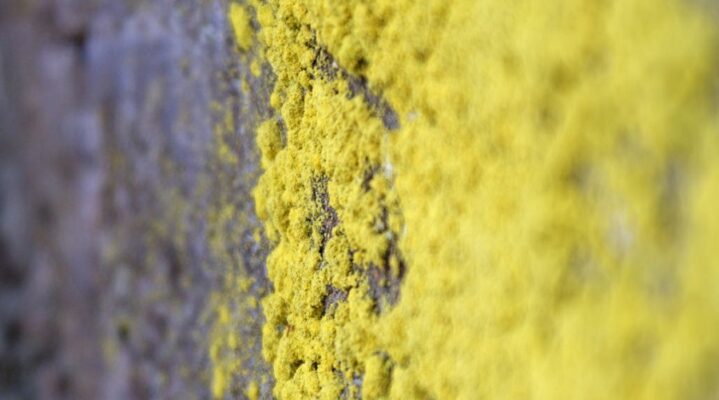

A gold-hungry bug opens door for more efficient biofuels

Researchers at the University of California – Berkeley have discovered that a bacterium named Moorella thermoacetica produces [...]

Oct

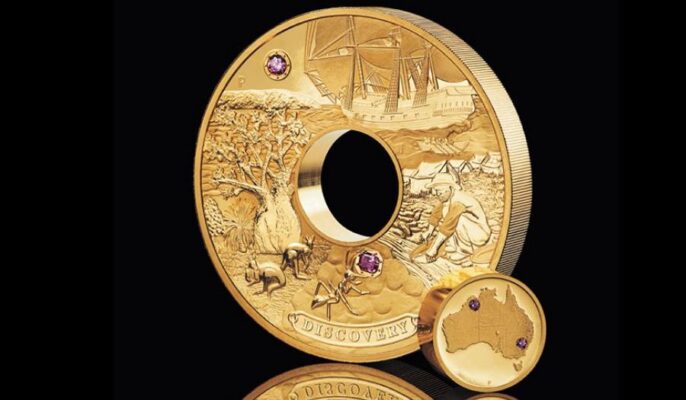

Perth Mint unveils Australia’s most expensive gold-diamond coin

The 2kg-coin comes in two parts, an outer ring and a centrepiece emulating colonial Australia’s [...]

Sep

Gold recoils amid selloff but may rebound

Gold has fallen to a 20-month low amid sharp EM currency depreciation. At these levels, [...]

Aug

Egyptian copper’s origin revealed

Copper is not only a hot commodity right now. It was very much so in [...]

Aug

Exports enjoyed double-digit growth in first half of year

Greek exports enjoyed double-digit growth in June and also in the first six months of [...]

Aug

Mining is Driving the World’s Leading Innovations, Improving Products and the World

What if you could produce a product essential to countless consumer items, without any greenhouse [...]

Aug